The Complete List of KPIs on Monetization

KPIs, or Key Performance Indicators, in the context of monetization, refer to specific metrics used to measure the financial performance and success of a business’s revenue-generating strategies. These indicators help organizations track the effectiveness of their monetization efforts, guiding decision-making and strategic planning to maximize profitability.

How do you measure how you are generating revenue? Use the following metrics / Key Performance Indicators also known KPIs.

-

Contents

- 1 Average Revenue Per User (ARPU)

- 2 Lifetime Value (LTV)

- 3 Time to First Purchase

- 4 Customer Acquisition Cost (CAC)

- 5 Cost Per Acquisition (CPA)

- 6 Customer Lifetime Value (CLV)

- 7 eCAC (Effective Customer Acquisition Cost)

- 8 eCPM (Effective Cost Per Mille)

- 9 Paid Conversion Rate

- 10 Return On Investment (ROI)

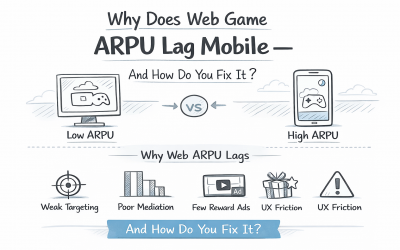

Average Revenue Per User (ARPU)

Starting with The Complete List of KPIs on Monetization post, the average amount of value or cash generated per user via in-app purchases, ad impressions or clicks, subscriptions, paid downloads, or other form of monetization. Multiplied by the size of the user base or the number of active users this figure gives a good rough idea of the value of the app as a whole.

Average Revenue Per User (ARPU) is a financial performance metric that helps companies understand how much revenue, on average, they are generating from each user or customer over a specific period. This metric is widely used across various industries, especially in telecommunications, media, technology, and subscription-based services, to gauge the effectiveness of their business models and monetization strategies.

The formula looks like this: ARPU=Average Number of Users / Total Revenue

Here are a few key aspects of ARPU:

- Insight into Revenue Generation: ARPU provides valuable insights into how well a company is generating revenue from its user base. It helps assess the monetary value of the user base, guiding pricing and marketing strategies.

- Benchmarking and Performance Tracking: By tracking ARPU over time, companies can benchmark their performance, identify trends, and make informed decisions to drive growth. It also allows for the comparison of performance across different market segments or products.

- Decision Making for Pricing and Services: Understanding ARPU helps businesses in making strategic decisions about pricing, product development, and service offerings. For instance, if ARPU is low, a company might consider introducing premium services or upselling strategies to increase revenue per user.

- Customer Segmentation: ARPU can aid in segmenting customers based on their revenue contribution. Companies can then tailor their marketing and customer service efforts to different segments, optimizing the allocation of resources

-

Lifetime Value (LTV)

Customer Lifetime Value (CLTV) is a critical metric used by businesses to estimate the total revenue they can expect from a single customer account over the course of their entire relationship. CLTV reflects the long-term value generated by customers, providing insights into how much revenue a customer will bring in from the moment they first make a purchase or sign up for a service until they stop doing business with the company. This metric is pivotal for understanding customer profitability and guiding strategic decisions related to marketing, sales, customer service, and product development.

Calculating CLTV involves several key components:

- Average Purchase Value: This is calculated by dividing the total revenue over a given period by the number of purchases during that period.

- Purchase Frequency: This measures how often a customer makes a purchase within a specified time frame.

- Customer Value: By multiplying the average purchase value by the purchase frequency, businesses can determine the customer value for that period.

- Average Customer Lifespan: This is an estimate of how long a customer will continue to do business with the company, usually measured in years.

The CLTV is then calculated by multiplying the customer value by the average customer lifespan, providing a monetary value that represents the expected revenue from a customer over the lifespan of their relationship with the company. The formula looks something like this:

CLTV=(Average Purchase Value×Purchase Frequency)×Average Customer Lifespan

Understanding CLTV has numerous benefits:

- Strategic Marketing and Sales: Knowing the CLTV helps businesses allocate their marketing and sales resources more effectively, focusing on acquiring and retaining high-value customers.

- Improved Customer Segmentation: Companies can segment their customer base by CLTV, allowing for more targeted and personalized marketing efforts.

- Pricing Strategy: Insights from CLTV can aid in developing pricing strategies that maximize long-term revenue rather than focusing solely on short-term gains.

- Customer Service Prioritization: Businesses can prioritize customer service and retention strategies for customers with higher CLTV, ensuring they maintain these valuable relationships.

- Product and Service Development: Understanding the long-term value of customers can influence decisions regarding product improvements or new offerings to meet the needs of high-value segments.

-

Time to First Purchase

Following on The Complete List of KPIs on Monetization post, Time to First Purchase is a Key Performance Indicator (KPI) that measures the duration between a new user’s initial engagement with an app and their first purchase within that app. This metric is particularly relevant for businesses operating in the digital space, such as mobile apps, software as a service (SaaS) platforms, and e-commerce platforms, where in-app purchases, subscriptions, or upgrades are common revenue models.

Understanding Time to First Purchase offers several key insights into user behavior and business performance:

- User Conversion Efficiency: This KPI helps businesses understand how effectively and quickly they are converting new users into paying customers. A shorter time to first purchase indicates efficient user onboarding and an appealing value proposition, while a longer time may suggest areas for improvement in user engagement or product offerings.

- Effectiveness of Marketing and Onboarding: It reflects the success of marketing strategies and the onboarding process in demonstrating the app’s value to new users, encouraging them to make a purchase sooner rather than later.

- Customer Engagement and Interest Level: The time it takes for a new user to make a purchase can also indicate their level of interest and engagement with the app. Users who see immediate value in the app are likely to purchase quicker.

- Product and Pricing Strategy Insights: Analyzing this metric alongside other user behavior data can provide valuable insights into product offerings and pricing strategies. For instance, if a significant portion of users takes a long time to make their first purchase, it may suggest that the app’s value proposition is not immediately clear, or that the pricing might not align with the perceived value.

You can calculate TFP by >>> Date/Time of First Purchase – Date/Time Registered (in days)

-

Customer Acquisition Cost (CAC)

CAC is a vital metric that measures the total average cost incurred by a business to acquire a new customer. This encompasses all expenses associated with marketing and sales efforts, including advertising, employee salaries, commissions, bonuses, and any other costs directly related to attracting and converting new customers. Essentially, CAC helps businesses understand the investment made to gain each new customer.

The formula to calculate CAC is:

CAC=Total Marketing and Sales ExpensesNumber of New Customers Acquired

It’s important to note that the explanation you provided mentions dividing the total gross revenue by sales and marketing costs, which seems to be a misunderstanding. Instead, the CAC is determined by dividing the total costs spent on acquiring more customers (marketing and sales expenses) by the number of new customers acquired during the same time period.

Here’s why CAC is crucial for businesses:

- Profitability Analysis: Knowing the CAC allows businesses to evaluate whether they can sustainably acquire new customers at a cost lower than the value those customers bring, crucial for long-term profitability.

- Efficiency of Marketing Efforts: It reflects the efficiency and effectiveness of marketing strategies and campaigns. A lower CAC indicates that a company is using its resources efficiently to acquire new customers.

- Budgeting and Financial Planning: Understanding CAC helps businesses allocate their marketing and sales budgets more effectively, ensuring they’re investing in the most efficient channels and strategies to attract new customers.

- Pricing and Product Strategy: Insights from CAC calculations can influence pricing strategies and product development. If CAC is high, a company may need to increase prices, reduce costs, or adjust its product offerings to maintain profitability.

- Investor Insights: For startups and companies seeking investment, a low or efficiently managed CAC is often attractive to investors, as it indicates the company has a scalable customer acquisition strategy.

-

Cost Per Acquisition (CPA)

Contiuning on The Complete List of KPIs on Monetization post, CPA is a more specific metric that measures the cost to acquire a customer action, which could be a purchase, but could also be a sign-up, a form submission, or another defined action that doesn’t necessarily involve a monetary transaction. CPA is widely used in advertising campaigns to evaluate the cost-effectiveness of different marketing channels and campaigns. It’s a key performance indicator for campaign success, especially in digital advertising.

CPA=Total Cost of a CampaignNumber of Acquisitions (Actions)

Key Differences

- Scope: CAC measures the cost of acquiring a new customer who makes a purchase or subscribes to a service, providing a holistic view of the effectiveness of overall marketing and sales strategies. CPA focuses on the cost of acquiring a specific action and is often used to measure the efficiency of individual marketing campaigns or channels.

- Purpose: CAC is used for broader business strategy and financial planning, helping businesses understand the investment required to expand their customer base. CPA is typically used to assess and optimize the performance of specific marketing campaigns and advertising efforts.

- Actions Measured: CAC specifically relates to acquiring new customers who make a purchase or engage in a revenue-generating activity. CPA could relate to any action defined as valuable by the advertiser, such as downloading an app, signing up for a newsletter, or completing a purchase.

Understanding both CAC and CPA allows businesses to comprehensively assess their marketing and sales efficiency, optimize their strategies for customer acquisition, and ensure the sustainability of their growth efforts.

-

Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) is a metric that estimates the total revenue a business can reasonably expect from a single customer account throughout the entirety of their relationship with the company. CLV is crucial for understanding the long-term value of customers and helps businesses make informed decisions about how much money they should invest in acquiring new customers and retaining existing ones.

To calculate CLV, you typically need to consider three main components:

- Average Purchase Value: Calculate this by dividing the total revenue over a certain period by the number of purchases in that period.

- Purchase Frequency: Determine this by dividing the number of purchases by the number of unique customers who made those purchases within the same timeframe.

- Customer Lifespan: Estimate the average number of years a customer continues purchasing from your business.

The CLV formula then combines these components, as follows:

CLV=Average Purchase Value×Purchase Frequency×Customer Lifespan

This formula gives a simplified version of CLV, but it captures the essence of its calculation. There are more complex models that can account for variables like the discount rate (in more refined, present-value CLV calculations) or varying margins and retention rates over time.

Importance of CLV:

- Strategic Focus on Profitable Customer Relationships: By understanding the lifetime value of customers, businesses can focus their efforts on acquiring and retaining customers who are likely to offer the highest return on investment over time.

- Resource Allocation: Knowing the CLV helps companies allocate their marketing and sales resources more effectively, focusing on strategies that increase the lifetime value of their customers.

- Pricing Strategies: Insights from CLV can inform pricing strategies, helping businesses set prices that attract and retain valuable customers while ensuring profitability.

- Customer Segmentation: CLV allows businesses to segment their customers based on profitability, enabling more personalized marketing efforts and improving customer retention strategies.

- Improving Products and Services: Understanding which customers are most valuable can guide companies in tailoring their products and services to meet the needs and preferences of those segments, fostering loyalty and increasing customer satisfaction.

-

eCAC (Effective Customer Acquisition Cost)

7th on the The Complete List of KPIs on Monetization List, Effective Customer Acquisition Cost (eCAC) is a metric that refines the traditional Customer Acquisition Cost (CAC) calculation by taking into account not just the direct costs associated with acquiring new customers (such as advertising expenses, marketing team salaries, etc.), but also incorporating the impact of organic growth mechanisms and customer referrals. Essentially, eCAC provides a more nuanced understanding of customer acquisition costs by acknowledging that not all customers require the same investment to acquire, especially when existing customers contribute to new customer acquisition through referrals or organic channels.

The formula for eCAC can vary depending on how a business decides to account for organic and referral growth, but at its core, the calculation attempts to distribute the cost of paid acquisition efforts more accurately across both directly acquired and organically acquired customers. This can be represented as:

eCAC=Total Marketing and Sales ExpensesNumber of New Customers Acquired Directly+Organic and Referred Customers

Why is eCAC Important?

- More Accurate Cost Assessment: eCAC offers a more accurate reflection of the true cost of acquiring new customers.

- Incentivizing Referral Programs: businesses can be more incentivized to invest in customer referral programs or strategies that enhance organic reach, potentially reducing the overall customer acquisition costs.

- Strategic Decision Making: companies can make more informed strategic decisions about where to allocate resources for customer acquisition.

- Optimizing Marketing Spend: eCAC helps businesses evaluate the effectiveness of their marketing spend by highlighting the contribution of less direct customer acquisition channels, potentially leading to a reallocation of budget to more efficient channels.

- Customer Relationship Value: Recognizing the role existing customers play in acquiring new ones through eCAC can lead businesses to value their current customer relationships even more, leading to increased efforts in customer satisfaction and retention strategies.

-

eCPM (Effective Cost Per Mille)

eCPM, or Effective Cost Per Mille (thousand), is a crucial advertising metric used to calculate the effective cost of every 1,000 impressions of an advertisement. Unlike traditional cost-per-impression (CPM) models, eCPM allows for the evaluation of advertising performance across different pricing models, including cost per click (CPC) and cost per action/acquisition (CPA), on a comparable basis. This makes eCPM a versatile and widely used metric in digital advertising for assessing the efficiency and profitability of ad campaigns across various platforms and formats.

The formula to calculate eCPM is:

eCPM=(Total EarningsTotal Impressions)×1000

Key Aspects of eCPM:

- Universal Comparability: eCPM provides a standardized way to compare the efficiency of advertising campaigns, regardless of the underlying pricing model. This means advertisers can assess the performance of CPC, CPM, and CPA campaigns side by side.

- Performance Measurement: It offers a clear metric to gauge how well an ad performs in terms of generating revenue. That helps advertisers to identify the most profitable placements or formats for their ads.

- Optimization Tool: Publishers and advertisers use eCPM to optimize their ad strategies. For publishers, it helps in identifying the most lucrative ad formats and placements. For advertisers, it aids in tweaking campaigns to improve visibility and effectiveness.

- Revenue Projection: eCPM can help publishers project future revenue based on historical data. By analyzing trends and patterns in eCPM values, publishers can make informed decisions about content and ad placement strategies to maximize revenue.

- Market Benchmarking: eCPM rates vary widely across industries, ad formats, and platforms. Advertisers and publishers can benchmark their campaign performance against market averages to evaluate their competitiveness.

-

Paid Conversion Rate

9th on the list The Complete List of KPIs on Monetization is Paid Conversion Rate. It is a KPI in digital marketing that measures the effectiveness of paid advertising campaigns in converting visitors into desired actions. These actions can include making a purchase, signing up for a newsletter, downloading a white paper, etc. Paid Conversion Rate quantifies the percentage of users who take a specific action as a result of clicking on a paid advertisement.

The formula for calculating the Paid Conversion Rate is:

Paid Conversion Rate=(Number of Conversions from Paid AdsTotal Number of Clicks on Paid Ads)×100

Importance of Paid Conversion Rate:

- Campaign Effectiveness: This metric directly reflects the success of paid advertising efforts in achieving specific objectives. A higher conversion rate indicates a more effective campaign that resonates well with the target audience.

- Budget Allocation: businesses can more effectively allocate their advertising budget to maximize ROI.

- Optimization Opportunities: Analyzing the conversion rates of different ads, landing pages, and campaigns can highlight areas for optimization. This could involve tweaking ad copy, improving landing page design, or refining the targeting criteria.

- Pricing Strategy Insights: The Paid Conversion Rate can also provide insights into the effectiveness of the pricing strategy for a product or service. For instance, if conversion rates are low despite high engagement, it may indicate that the price point is a barrier.

- Customer Acquisition Cost (CAC): Understanding the conversion rate from paid ads is crucial for calculating the cost of acquiring a new customer through paid channels, which in turn affects overall marketing strategy and profitability analyses.

This systematic approach allows for data-driven decisions that can significantly enhance the effectiveness of paid advertising campaigns.

-

Return On Investment (ROI)

Last but not least on my The Complete List of KPIs on Monetization post is Return on Investment (ROI). Essentially, ROI calculates the percentage return on a particular investment, making it easier to compare the efficiency of several different investments.

The formula for calculating ROI is: ROI=(Net ProfitCost of Investment)×100

Components of ROI:

- Net Profit: The earnings from the investment after subtracting all expenses associated with the investment.

- Cost of Investment: The total amount invested initially.

Importance of ROI:

- Performance Measurement:- ROI is a straightforward and universally understood measure of investment performance. It helps investors assess the efficiency and profitability of their investments.

- Comparative Analysis:- it allows for the direct comparison of investments of different scales and types, facilitating better investment decisions.

- Decision Making:- guiding strategic decisions on where to allocate resources for the best financial return.

- Marketing and Business Strategy:- assessing the effectiveness of marketing campaigns ensuring that the returns justify the expenditures.

Limitations of ROI:

While ROI is a valuable tool for investment analysis, it has limitations. It does not account for the time value of money, making it less accurate for comparing investments over different time periods without adjustment. Despite these limitations, ROI remains a fundamental concept in finance and business for evaluating and comparing the profitability of investments.